Chennai — March 1, 2026 (Sunday)

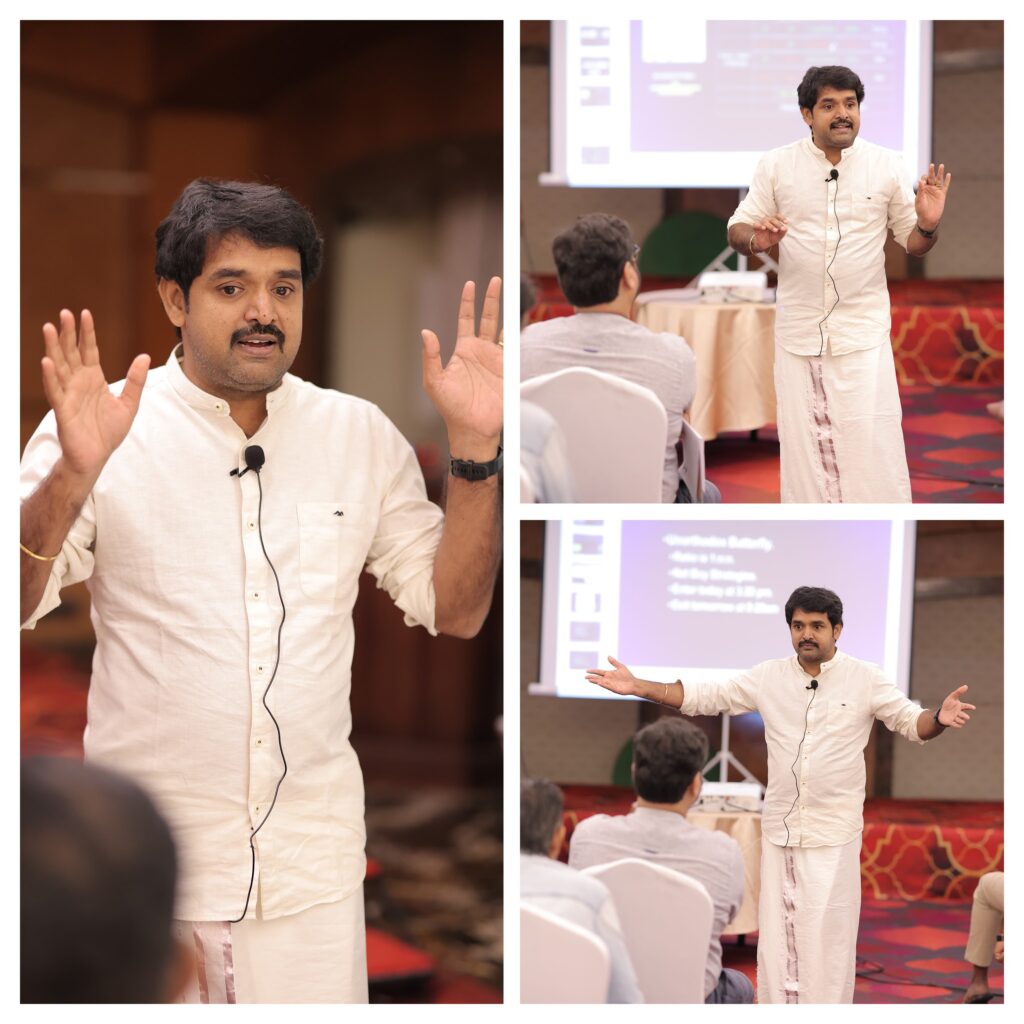

IT JEGAN’s Expert Educational Course On Option Trading

Topics Covered

- ➤ Understanding how to hedge stock option exposures using index derivatives for directional risk control.

- ➤ Market behavior analysis for expiry-day and non-expiry sessions, including volatility characteristics.

- ➤ Frameworks for designing statistically uncorrelated option strategies.

- ➤ Studying intraday behavioral tendencies across different trading days.

- ➤ Evaluating performance differences between overnight-held and intraday spread structures.

- ➤ Historical trend analysis using index options to understand directional characteristics.

- ➤ Principles of risk-adjusted position sizing and effective margin utilization.

- ➤ Approach to scaling-in during sustained directional moves (case-based illustrations).

- ➤ Differentiating momentum behavior from broader trend formation.

- ➤ Quantitative ranking and rebalancing methods for systematic equity allocation.

- ➤ Trading psychology fundamentals for disciplined execution.

• Venue : Yet to Announce

• Language : English

• Amenities : Buffet lunch with refreshments included

• Time : 9:00 a.m – 5:00 p.m

• For queries : Reach us at +91 99621 43422, contactus@capitalzone.in

• FAQs : Check detailed program FAQs here .

Disclaimer

In compliance with SEBI Circular No. SEBI/HO/MIRSD/MIRSD-PoD-1/P/CIR/2025/11, no live, real-time, or recent (less than 3 months) market data is used in any part of this presentation.The presenter is not a SEBI-registered Research Analyst or Investment Adviser. No buy, sell, or hold recommendations are provided for any security, derivative, or instrument. Participants are strongly advised to consult a SEBI-registered professional before acting on any investment or trading decision.

In compliance with SEBI Circular No. SEBI/HO/MIRSD/MIRSD-PoD-1/P/CIR/2025/11, no live, real-time, or recent (less than 3 months) market data is used in any part of this presentation.The presenter is not a SEBI-registered Research Analyst or Investment Adviser. No buy, sell, or hold recommendations are provided for any security, derivative, or instrument. Participants are strongly advised to consult a SEBI-registered professional before acting on any investment or trading decision.