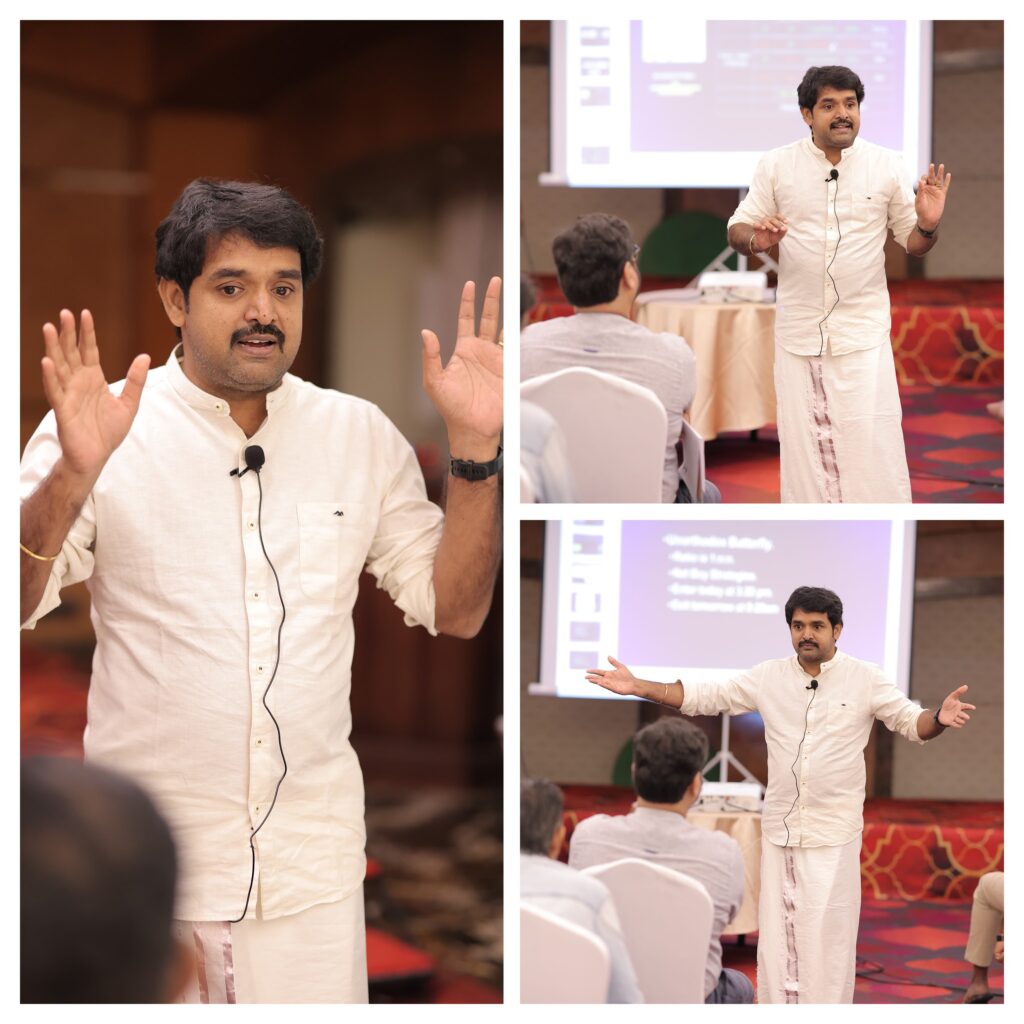

ITJEGAN’s Expert Educational Course On Option Trading

Topics Covered

- Concept of hedging stock options using index derivatives for directional risk management.

- Studying expiry-day behavior, market patterns on non-expiry sessions and volatility characteristics.

- Framework learning to design statistically uncorrelated option strategies.

- Analyzing intraday behavioral tendencies across trading days.

- Comparing overnight and intraday spread performance characteristics.

- Historical trend analysis using index options.

- Principles of risk-adjusted position sizing and Margin Management

- Scaling-in methodology during sustained directional phases (case study format).

- Differentiating momentum behavior from long-term trend formation.

- Quantitative ranking and rebalancing models for systematic portfolio allocation

- Trading Psychology

Venue : Yet to Announce

Language : தமிழில்

Amenities : Buffet lunch with Refreshments will be included.

Time : Morn 9.30am – 5.30pm

For any queries, reach us @ +91 9962143422, contactus@capitalzone.in

FAQs : Check out here all details, related to the learning progam.

Disclaimer This workshop is conducted for educational and training purposes only. It does not provide investment advice or trading recommendations. There is no guarantee of profits or returns from any strategies, illustrations, or discussions presented. Data used is historical ( more than 3 months old ), and no live trading or real-time data is discussed. Participants are advised to consult SEBI-registered investment advisors before making any investment/trading decisions.